#Backblaze ipo worth it install

When you first install the programme, it immediately scans your hard drive for all files (except for operating system files, applications and temporary files which may cause complications when trying to restore them) and gives you an overview of the files to backup. Here’s why Backblaze works well for your backup needs:īackblaze’s strength lies in the simplicity of its design. What makes Backblaze a worthwhile backup cloud storage provider is how it is engineered specifically for simple usage with all the necessary basic functions that doesn’t require much work on the user’s part. Still, with over an exabyte (1 billion GB) of data stored thus far, it really is the best choice for simple and convenient backing up of your computer files. Granted, it isn’t the best solution for cloud storage (see pCloud for that instead).

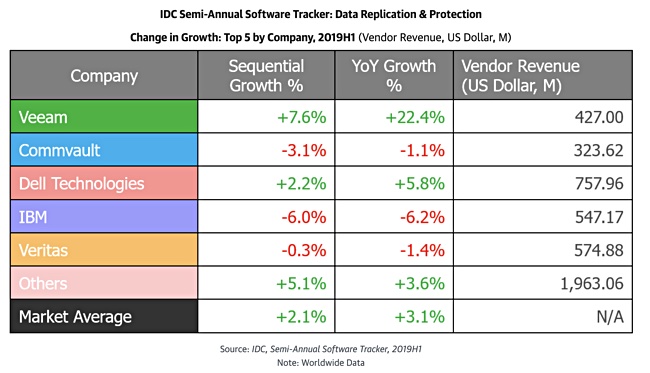

Substantially all of Backblaze’s revenue is recurring. Our sales-assisted selling motion has experienced substantial growth and helps customers that, in 2020, were approximately 20 times larger in terms of average revenue per customer than our self-serve customers.” Our content encourages organic, inbound traffic that we believe serves as our greatest source of advocates and referrals.”Īnd, “in recent years we have begun to invest in a sales-assisted selling motion to identify opportunities to increase business with existing customers and to assist larger customers in adopting our services. We have fostered deep community engagement with valuable content we share on our blog - in 2020 alone, more than 3 million readers consumed content that we shared there. Prospective customers find us through a variety of channels including our website, partners, and brand advocates. Its filing states: “We have a highly efficient go-to-market model that is built on a self-serve selling motion. The company has relatively has low sales and marketing costs. Backblaze also cites on-premises offerings from Dell EMC and NetApp as competition.īackblaze revenue and profit/loss numbers from the S1 filing. Its main competition comes from the big three CSPs: Amazon, Azure and Google. There are two main products: B2 Cloud Storage and Computer Backup. A 2012 Budman blog says Backblaze took in $5 million from TMT Investments. Prior to issuing $10 million of convertible notes (which we also refer to as a Simple Agreement for Future Equity agreement (SAFE)) in a private financing round in August 2021, we had raised less than $3 million in outside equity since our founding in 2007.” The filing states: “Our operations have historically been efficient with limited outside investment.

#Backblaze ipo worth it plus

Consequently its funding events have been sparse: $300K in 2009, a $5 million A-round in 2012, and a $2 million event in 2020 plus a $10 million convertible note round in August this year.

The company was incorporated in 2007 and decided not to go the venture capital route, preferring to bootstrap its operations. This solidarity helped us build and sustain our culture through the first 14 years of our evolution.” That gives an insight into the somewhat unique company culture at Backblaze. Backblaze’s filing also says the founders “formed a salary tontine where, until the public offering is finalised, a core group of the original founders and some other very early employees agreed to make the same salary.

0 kommentar(er)

0 kommentar(er)